Fintech has become a popular term in the media and tech circles, but what is it exactly?

Put simply, fintech is technology used in financial services. Originally (i.e., in the 1960s and ’70s), this technology almost exclusively focused on back-end efficiencies. Today, it has evolved to include mobile banking and trading, peer-to-peer lending, digital wallets and robo-advisors, as well as security, identity management and authentication.

A group of experts at RBC Investor & Treasury Services’ 2016 Investor Forum, held recently in Toronto, shared their perspectives on fintech and how the evolution of this disruptor might help meet increasing consumer demands.

Fintech innovation is taking place inside financial institutions and within the technology startup community – often in partnership. Regardless of where the technology is developed, it is becoming increasingly clear that fintech is critical to the future of the financial services industry. Consider the numbers: “Pulse of Fintech,” a report by KPMG and CB Insights, indicates that global investment in fintech companies totaled USD 19.1 billion in 2015, up 106% from 2014.

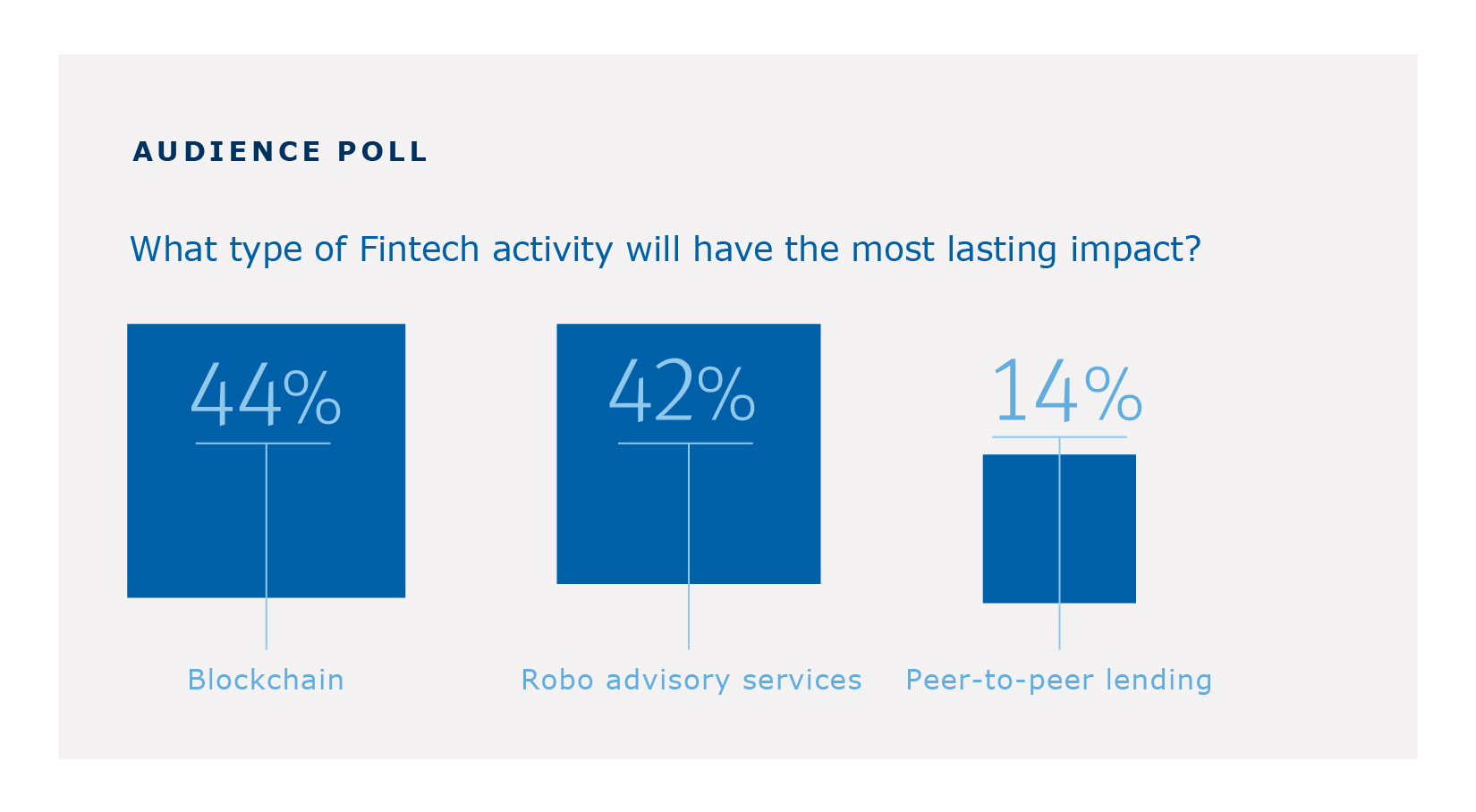

The power of blockchain

Blockchain is a foundational technology which facilitates the creation of a ledger of transactions in a series of blocks that can be added together chronologically and securely shared among a distributed network. This technology is of particular interest to financial institutions, providing the potential to enable a more efficient, scalable financial services infrastructure.

Initially, blockchain was viewed as the underpinning transactional technology that made digital currency Bitcoin possible. Over the past 12 to 18 months, financial institutions from around the world have been experimenting with blockchain, forming consortia to build compatible networks in order to realize the power of this technology.

RBC is very much involved in this space both as part of a consortium and as a technology developer, working in partnership with startup companies to explore blockchain’s potential within the bank. One such initiative involves the use of blockchain as the ledger for RBC’s loyalty program.

Blockchain is but one example of a potentially game-changing technology in the financial services industry but there is no shortage of new ideas. According to panellists, this likely won’t change anytime soon, even in light of heightened regulation and increased compliance costs.

Panellists acknowledged these challenges and noted that the financial services industry is at an inflection point because of this emerging technology. They also agreed that it will be necessary for regulators to develop more innovative and adaptive rules and regulations to ensure systemic stability, protect consumers and improve transparency.