Services

FX Standing Instructions

Outsource FX requirements on the back of security trades, dividends, income, subscriptions, redemptions, and more.

Currency Overlay Services

A flexible, automated solution for three distinct hedging strategies:

- Share class hedging

- Portfolio hedging

- Benchmark hedging

Unity FX

Fully-delegated operational solution for the execution of FX requirements, irrespective of the appointed custodian or investment manager

Direct FX

Client-directed live FX service, extensive liquidity and flexible, robust e-trading solutions through both proprietary and multi-bank platforms

Core features

- FX servicing in more than 70 currencies

- FX trading desks in Toronto, London, and Singapore

- 24/5 execution capabilities

- Independent benchmarking and transaction cost analysis

RBC One

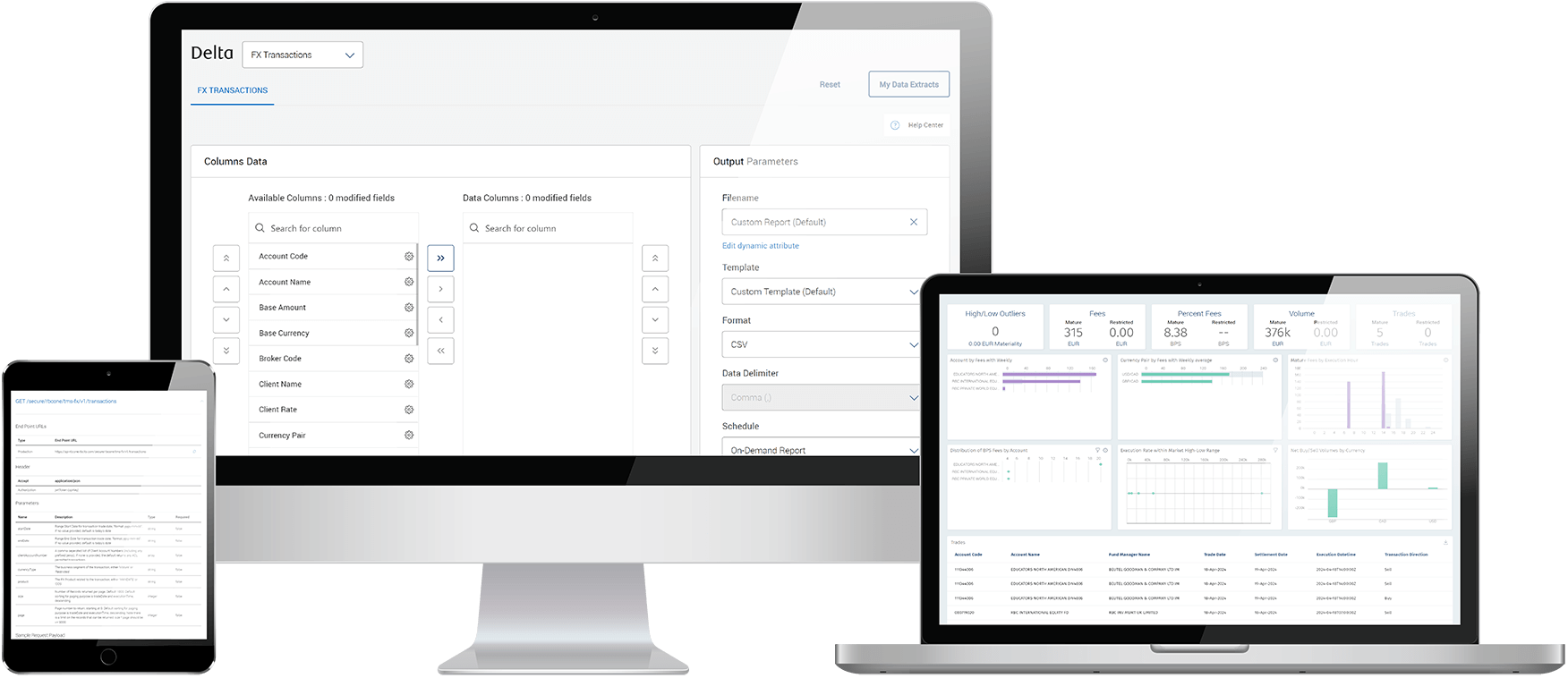

Enabling trusted data

Our RBC One digital ecosystem provides transparent, on-demand data to support your day-to-day business objectives in a secure environment.

Features

- Perform daily oversight of FX activities across all accounts with an in-depth view at transaction level

- Extract highly customizable data sets for seamless integration into investment manager systems

- Quantify execution costs vs mid-market benchmarks and assess the execution quality, performance and cost of all trades

Insights

Market Services FX Spotlight

The December 2025 edition of Market Services FX Spotlight features global market news and insights from RBC Investor Services’ FX Market Trading Desk.

Market Services FX Spotlight

The November 2025 edition of Market Services FX Spotlight features global market news and insights from RBC Investor Services’ FX Market Trading Desk.

FX risks move to the forefront

RBCIS recently hosted a webinar with CPBI to discuss the currency market’s impact on portfolios and how to implement FX solutions with a trusted partner to better manage risks.