RBC One

Enabling trusted data

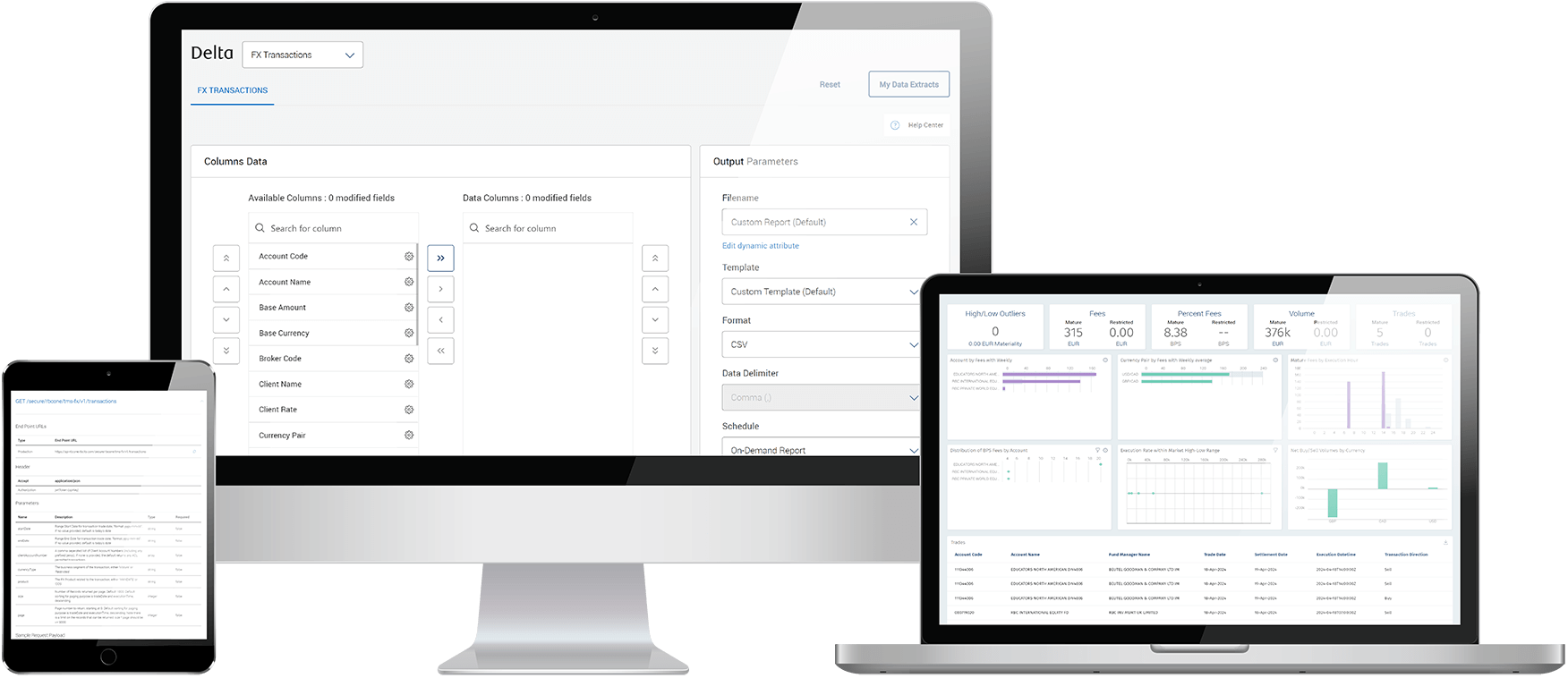

Our RBC One digital ecosystem provides transparent, on-demand data to support your day-to-day business objectives in a secure environment.

Features

- Perform detailed oversight of all hedge program parameters and trade execution details

- Access share class hedging analytics to track and deconstruct individual components of NAV performance variance

- Extract highly customizable data sets for seamless integration into investment manager systems

Insights

Market Services FX Spotlight

The December 2025 edition of Market Services FX Spotlight features global market news and insights from RBC Investor Services’ FX Market Trading Desk.

Market Services FX Spotlight

The November 2025 edition of Market Services FX Spotlight features global market news and insights from RBC Investor Services’ FX Market Trading Desk.

FX risks move to the forefront

RBCIS recently hosted a webinar with CPBI to discuss the currency market’s impact on portfolios and how to implement FX solutions with a trusted partner to better manage risks.