Services

At RBC Investor Services, our diverse range of comprehensive fund administration services go beyond core fund accounting functions to deliver added value for investment managers and asset owners. We collaborate closely with our clients to implement tailored, high-touch solutions that help to optimize performance and growth in a rapidly evolving market landscape.

- Portfolio valuation

- NAV calculations

- Financial reporting and statements

- Performance fee calculation

- Distribution calculations

- NAV dissemination

- Derivative services

- ETF services

- Investment compliance

- Tax administration

Trusted accuracy & expertise

CAD 600 billion+

Assets under administration

99.99%

NAV accurate rate

125+ years

of experience delivering trusted investor services

1.6 million+

NAVs calculated

2200+

Funds administered

CAD 600 billion+

Assets under administration

99.99%

NAV accurate rate

125+ years

of experience delivering trusted investor services

1.6 million+

NAVs calculated

2200+

Funds administered

Data as of Q3 2024

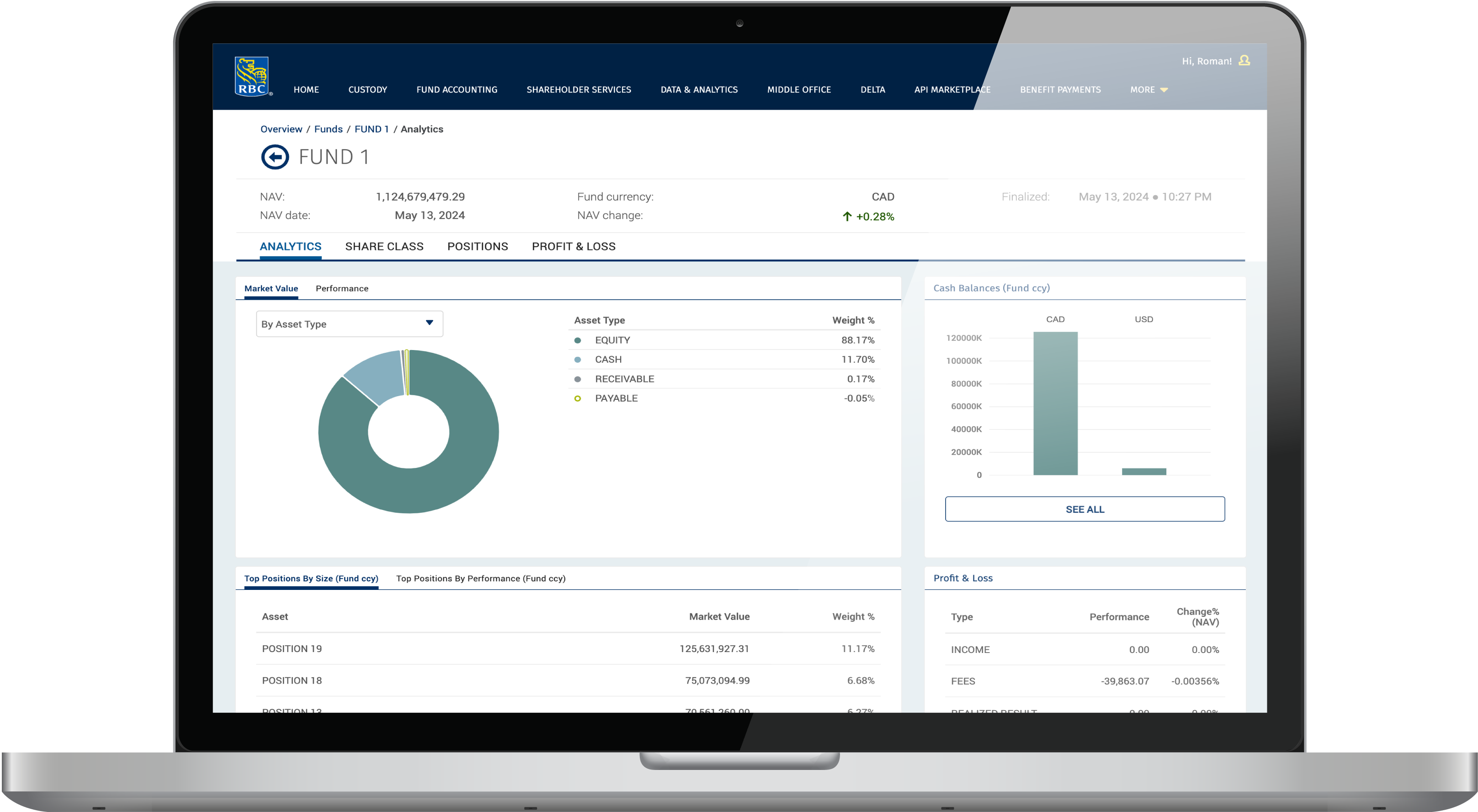

RBC One

Enabling trusted data

Oversee fund and share class performance through convenient access to fund information including NAVs, underlying positions and data visualization capabilities.

Features

- Compare share class performance

- View aggregate currency positions

- Monitor top position allocations per fund

- Analyze profit and loss distribution factors

Insights

RBC Financial Markets Monthly

The April 2025 edition of Financial Markets Monthly from RBC Economics includes a forward-looking analysis of Canadian, US and international financial market trends.

Market Services FX Spotlight

The April 2025 edition of Market Services FX Spotlight features global market news and insights from RBC Investor Services' FX Market Trading Desk.

RBC Quarterly Macroeconomic Outlook

RBC Economics presents an in-depth analysis of the key drivers of economic activity in Canada and the US, including global factors that affect near-term forecasts.