By Kellen Jibb, Associate Director, Market Services Solutions, and Taylor Richardson, Head of FX Market Trading

Over the past decade, foreign exchange (FX) markets—particularly USD/CAD—have been defined by relative stability, supported by clear monetary policy guidance, predictable trade flows and strong economic linkages between Canada and the US. This has historically made USD/CAD a relatively boring trade in the FX space. But that period of calm has given way to a new era of heightened volatility, making currency hedging an attractive risk mitigation strategy.

In recent months, we’ve seen firsthand how spikes in CAD volatility—unseen since the mid-2010s outside of brief shock periods—have prompted a need for more tailored currency hedging strategies. The primary driver of this renewed volatility is the escalation in US–Canada trade tensions following the Trump administration’s calls for aggressive tariffs on Canadian exports.

US policy decisions are clearly having a major impact on the USD/CAD pair

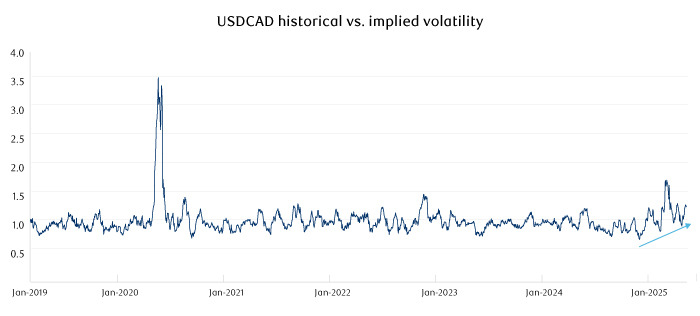

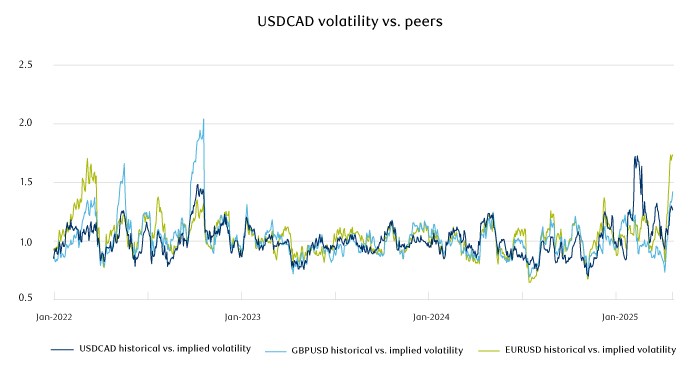

Excluding the COVID crisis, the USD/CAD historical-versus-implied volatility ratio reached its highest point in more than 10 years in February 2025 and remains elevated. This ratio also jumped significantly above its G10 peers, a departure from its traditionally sleepy profile. US policy decisions are clearly having a major impact on the USD/CAD pair in addition to its global counterparts like the Euro and the British Pound.

The ratio of historical to implied volatility in USD/CAD has been its highest since COVID, and the trend shows potential further uncertainty to come.

Following a spike in February 2025, USD/CAD has settled below EUR/USD and GBP/USD in terms of volatility but remains at elevated levels.

Tensions from all sides

Market expectation now points toward a more confrontational trade environment, threatening to upend the long-standing economic interdependence between Canada and the US. Canada sends more than three quarters of its exports to the US while almost a fifth of American exports flow north, meaning any external friction like tariffs can have a major effect on both economies and their respective dollars.

Canadian asset managers now face a difficult choice when assessing US exposure

In addition to rising trade tensions, a widening short-term interest rate gap between the US and Canada (driven by softer Canadian growth, earlier Bank of Canada rate cuts and removal of forward guidance, and sustained US economic resilience) has contributed to a notable appreciation in the US dollar over the past six months prior to the April 2025 downturn. With the USD now reversing course and declining over the past few weeks, cracks have emerged in the historically strong inverse correlation between the US dollar and US equities. Canadian asset managers now face a difficult choice when assessing US exposure and are looking for partners to help mitigate these risks.

To hold, or not to hold: that is the question

At RBC Investor Services (RBCIS), we’ve been actively monitoring the current phase of FX market stress, which is not strictly cyclical. It reflects a structural shift toward a more politically driven and fragmented global economy. While we don’t have a clear view of how the trade landscape will transform on the back of tariff announcements, or even if today’s tariff environment will be the same as tomorrow’s, there is likely more uncertainty to come.

What is clear today is the serious risk involved in being exposed to the US market—an exposure that is common across nearly all Canadian investment managers.

In our experience, there are four tactics that can be employed to help navigate this exposure:

- Wait and see: This approach was becoming more common after several false starts in the tariff world but is less prevalent now after the most recent (and very real) tariff implementation. Some traders are still opting to stay on the sidelines until a clearer picture comes into view but the downside here is missing the boat and being unable to react quickly or aggressively in response to headline risk, and in never reaching a point of clarity. What’s predictable is that headlines coming out of the US administration are unpredictable.

- Trim exposure: The Elbows Up/Buy Canadian movement may already be extending to Canadian managers trimming their exposures to US companies. The perpetual concern around US government funding coupled with tariff threats on the profitability of US domestic firms may be driving some managers to consider diverting investment dollars to more stable markets like Europe, Asia–Pacific or Canada itself.

- Take a view: Some portfolio managers and asset owners see an opportunity to trade on this volatility, with a view that trade policy and geopolitical events have an attainable and probable conclusion. These investment professionals may find a way to take the right side and generate meaningful alpha on these macroeconomic events. The risk is that the US administration reacts entirely unpredictably and that the right trade can go wrong very quickly.

- Hedge the risk: A sensible approach might be to simply mitigate this volatility through a passive hedge on the USD. Canadian managers exposed to the USD have enjoyed nearly two decades of USD outperformance and many are now considering whether it is time to lock in their gains and hedge against a further USD freefall. Canadian managers can retain exposure to their US investments while mitigating the effects of a drawn-out trade war and future political uncertainty. Fund managers are also expanding their product offerings to include CAD-hedged solutions on their shelves, allowing the retail investor to make their own decision on this critical FX risk.

Case study: Partnering with Marval Capital to mitigate risk

How RBCIS can help: Derisking with a trusted partner

Organizations should connect with a provider that can help them determine the right path forward. Investment managers looking to hedge out their foreign currency exposures on a more passive basis, or to launch additional hedged share class products for their underlying investors, can consider the RBCIS Currency Overlay Services program.

Currency Overlay Services makes dynamic use of custody, fund accounting and transfer agency data to automatically hedge client exposures in dozens of currencies. With independently benchmarked execution, tailored hedging strategies and full transparency, Currency Overlay clients have the confidence to focus on individual security selection knowing that their currency positions are hedged to fully match their strategies.

Currency Overlay clients have the confidence to focus on individual security selection knowing that their currency positions are hedged

Those managers with a view on where currencies might go can trade FX directly with the RBCIS FX desk, giving them autonomy to enter and exit currency positions at live, competitive prices. Custody clients trading directly with the RBCIS FX desk also enjoy later cutoffs and simplified settlement processes, providing them the agility to make decisions quickly without the need for complex post-trade operations. Managers can also use the FX desk to hedge their exposures at a ratio of their choosing, with the ability to change at any time as market conditions fluctuate.

Looking ahead

Navigating the uncertainty in financial markets is a challenge to begin with and is exacerbated by unpredictable trade policy and unprecedented threats to growth and profitability. When faced with elevated risks in equities, fixed income, trade relationships, geopolitics and currencies, the logical choice for many asset managers is to mitigate or eliminate one of them, allowing them to focus their attention on the others.

Reach out to us today to learn how we can tailor a currency hedging solution that aligns with your investment strategy.