The traditional private equity model (i.e., a pooled fund controlled by a general partner (GP) entrusted by limited partners (LPs) to make investment decisions), is undergoing a transformation. Instead of allocating funds into private equity vehicles, some LPs are choosing to co-invest, and enter into transactions or deals alongside their GPs.1

Co-investing has growing appeal, with 42 percent of LPs acknowledging they participated in such deals, while 12 percent said they would consider doing so.2 In response to growing investor requests, more managers are beginning to offer co-investment opportunities.3

Key insights

- Private equity firms are increasingly competing on deals with institutions who traditionally would have been their core clients

- The chief advantages of the direct investment approach include the potential for better returns and the absence of the traditional 2 and 20 fee structure

- Direct investing carries risk and LPs will need to ensure they hire experienced and qualified private equity professionals to mitigate such challenges

Co-investing is often viewed as a stepping stone towards direct investing, where well-capitalized institutions build out proprietary sourcing, deal and operational teams enabling them to execute transactions in-house without third-party manager intervention.4 This approach could, in the long-term, be detrimental to private equity capital raising.

Direct investment strategies, while not new, have historically been the domain of large-scale investors. For example, well-endowed Canadian pension funds and Middle Eastern sovereign wealth funds (SWF) have been direct investors for nearly two and a half decades.5

Direct investing is now evolving to become more mainstream across a wider spectrum of well-resourced LPs, with GPs now competing against LPs in the auction process.6According to BCG, "The number of deals in which these historically passive LPs invested directly grew an average of 16 percent per year from 2009 to 2017."7

Going direct: a new normal

The transition towards direct investing is largely driven by allocators searching for better returns. 67 percent of LPs cite performance as the main reason behind their decision to go direct, with some experts estimating returns of up to five percent higher compared to putting money to work in a traditional private equity fund.8

As more pension funds, insurers and SWFs look to better match their liabilities with future obligations,9 direct investing is an attractive proposition when benchmarked against low to negative yielding sovereign bonds and volatile equities. Furthermore, direct deals allow institutions to exert greater influence over their portfolio company's strategic direction, often by negotiating a seat at the board.10

Private equity fees have also been a catalyst for the surge in direct LP investing. LPs usually pay their GPs a 2 percent management fee plus 20 percent in carried interest, but there has been growing dissatisfaction with private equity fee practices among regulators, such as the Securities and Exchange Commission (SEC), as well as end investors.

Direct LP investing, whether in conjunction with a GP or performed independently, will take place outside of the pooled fund structure meaning carried interest and management fees are often disapplied,11 or at least significantly reduced helping to amplify returns. With institutions including public pension plans facing growing scrutiny over the amount of carried interest paid to private equity,12 cost-conscious investors may opt to pursue more direct deals.

Managing the challenges of direct investing

Direct LP investing is not a risk-free undertaking. While the absence of carried interest may enhance returns, the caveat is that LPs incur greater concentration risk by investing in a smaller number of companies in comparison to investments through pooled fund set-ups.13

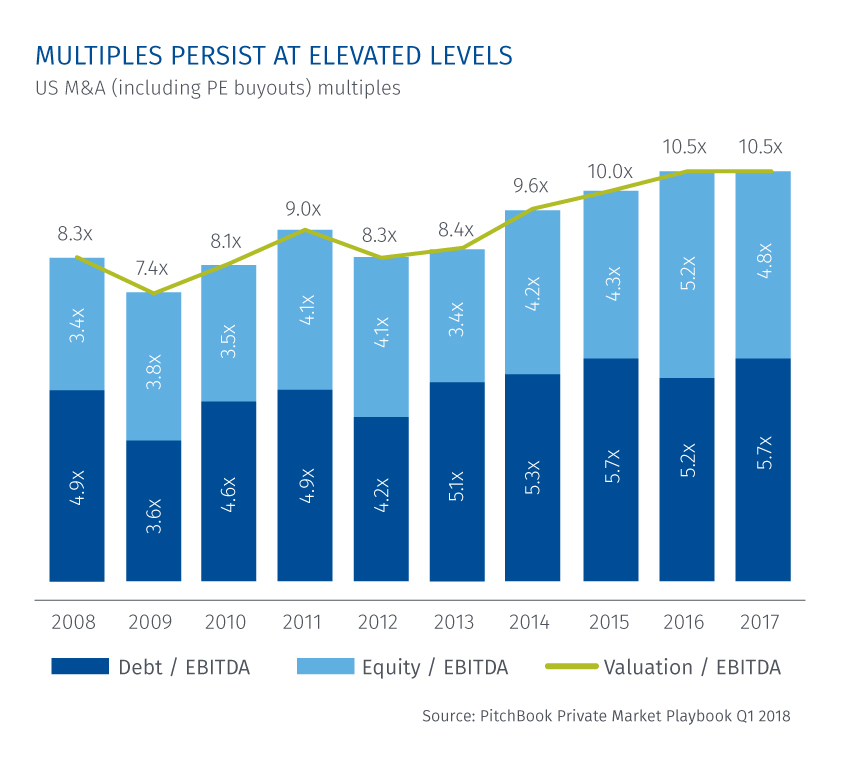

In a market where deal multiples are hovering at 10 times EBITDA (earnings before interest, tax, depreciation, amortization), co-investments look attractive from a return perspective,14 but could become less so if valuations drop in response to equity market volatility.

The transition from a fee-paying LP in a private equity fund to a direct or co-investor, co-underwriter or co-sponsor can be a steep learning curve. LPs in Europe and the US, relative to Canada, tend to be more conservative, and a transition into direct investing may require internal cultural shifts.15

From a governance perspective, “boards need the ability to provide effective oversight without overly constraining investment capabilities," noted a report by EY.16 LP boards have an obligation to monitor transactions, but deal teams do require flexibility and should not be overly influenced by political influences or micromanagement.17

Any move into direct investing will also require LPs to rewrite their recruitment policies, hiring private equity professionals and bridging remuneration gaps to ensure they attract the best talent; institutions that paid performance-related pay were three times more likely to be delivering above-average PE returns.18